1099 G Form Colorado Understandin A Comprehensive Uide To Tax And

The colorado department of labor & employment. Turbotax has prefilled the amount of the refund i see on my 2023 colorado individual income tax return form. If you itemized deductions on your federal return in the same year that you received the state or local refund, the refund may be considered taxable income.

Understanding 1099 G Colorado A Comprehensive Guide To Tax Forms And

We would like to show you a description here but the site won’t allow us. On the did you get a state or local tax refund in 2024? Find out what to do if you are a victim of identity theft or have an overpayment of your benefits.

File your individual income tax return, submit documentation electronically, or apply for a ptc rebate.

Each tax type has specific requirements regarding how you are able to pay your tax liability. Learn more about each tax type and how to pay them. Learn how to manage your tax account using revenue online. Can someone provide me the ein and address for the state of colorado.

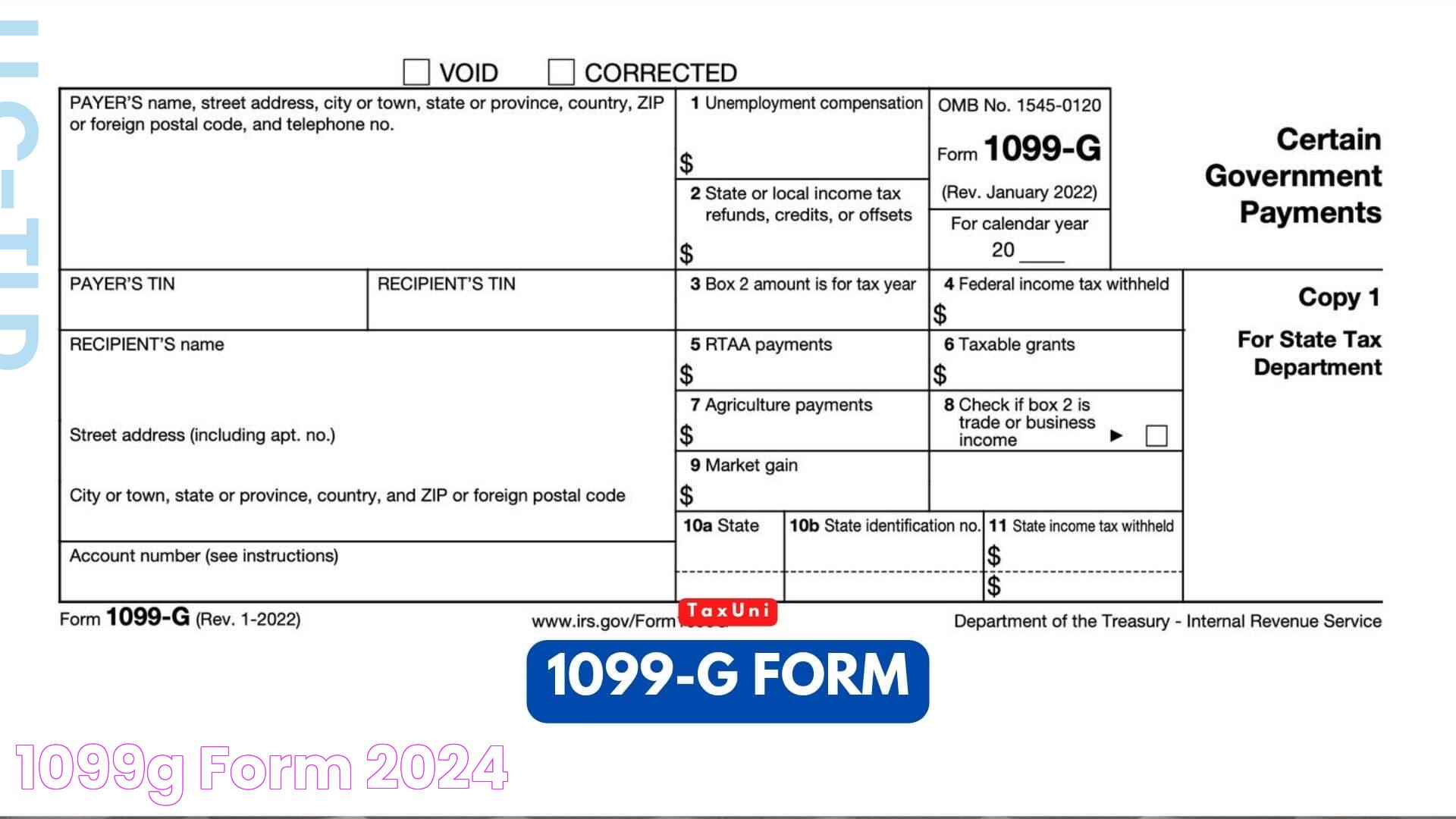

I doubt it's taxable because the client didn't itemize last year, but the program will give me errors if i don't provide. This form shows the amount of benefits you were paid during the previous year and the amount of income tax withheld, if you selected that option. Yes, in colorado, along with form 1099, you are required to file an additional form, colorado has an additional requirement of form dr 1106 (annual transmittal of state 1099 forms). Can i efile 1099 forms with colorado?

Frequently clients don’t bring us the 1099gs for the state refunds and we are held up waiting to get the eins and addresses that would appear on the 1099gs.

Here is the list of necessary information for all of the states’ 1099g. I left both state and locality blank. All of the details in the fields below that i previously entered had been wiped. Active claimants will have this new option starting on january 2, 2025.

Find the ein and address for a 1099g form from the state. Thank you very much for your help. There are no fees for opening a withholding account. The form is in postcard format.

Amounts on this form include:

Colorado income tax refund you received the prior year