Colorado 1099 G Tax Refund Understandin A Comprehensive Uide To Forms And

Check the instructions on your tax form to see how to report the unemployment benefit income and the amount repaid. We would like to show you a description here but the site won’t allow us. The division provides you with monthly records of your repayments.

Understanding 1099 G Colorado A Comprehensive Guide To Tax Forms And

You can reference the monthly statements to determine the total amount you repaid during the year. Find the ein and address for a 1099g form from the state. Check the status of your refund and your address by visiting revenue online.

You can request that the original refund be voided and a new refund be issued.

Follow the reissue process below. You can start the refund check reissue process by signing a refund reissue letter. Under the tax benefit rule, if a taxpayer received a benefit from deducting state and local taxes in a prior year, any refund must be reported as income. If you itemized your deductions in 2020, you may have to report this colorado state income tax refund as reportable income in 2021.

Select federal, and then income & expenses. Select other common income then select refunds received for state/local tax returns. You can get this amount from your state or local tax return for the tax year of the refund. Look for a line near the bottom, often bolded, that includes the phrase total payments.

This is done with a line item on the state income tax return, and paid out together with the taxpayer's income tax refund (or credited to their income tax liability).

However, the tabor refund is actually characterized as a refund of state sales tax. See for instance line 33 of colorado 2022 form dr 0104: Forms requested after 3/31/21 will have to be filed with your 2022 taxes. In such cases, only the portion of the refund that corresponds to the deductible amount is taxable.

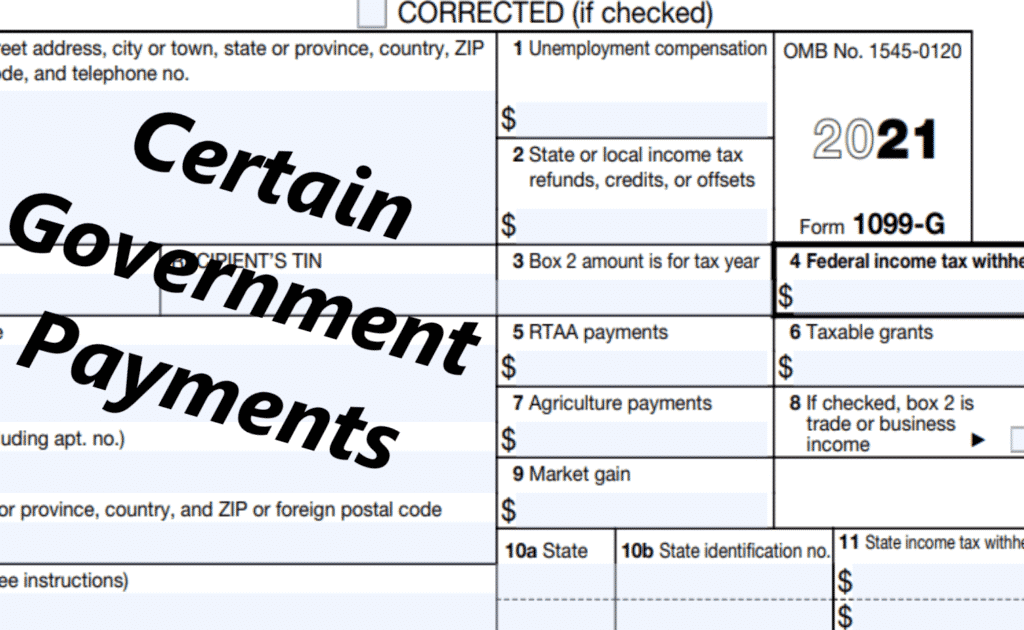

Review your previous year’s tax return to determine the exact taxable portion of your refund. Where to enter refund on form 1040. To avoid discrepancies, report your state tax refund accurately on form 1040. Use schedule 1, where taxable

I have he city and zip code unless it changed from 2022.

Here are some answers to common questions about this form: We would like to show you a description here but the site won’t allow us. Turbotax has prefilled the amount of the refund i see on my 2023 colorado individual income tax return form. Thank you very much for your help.

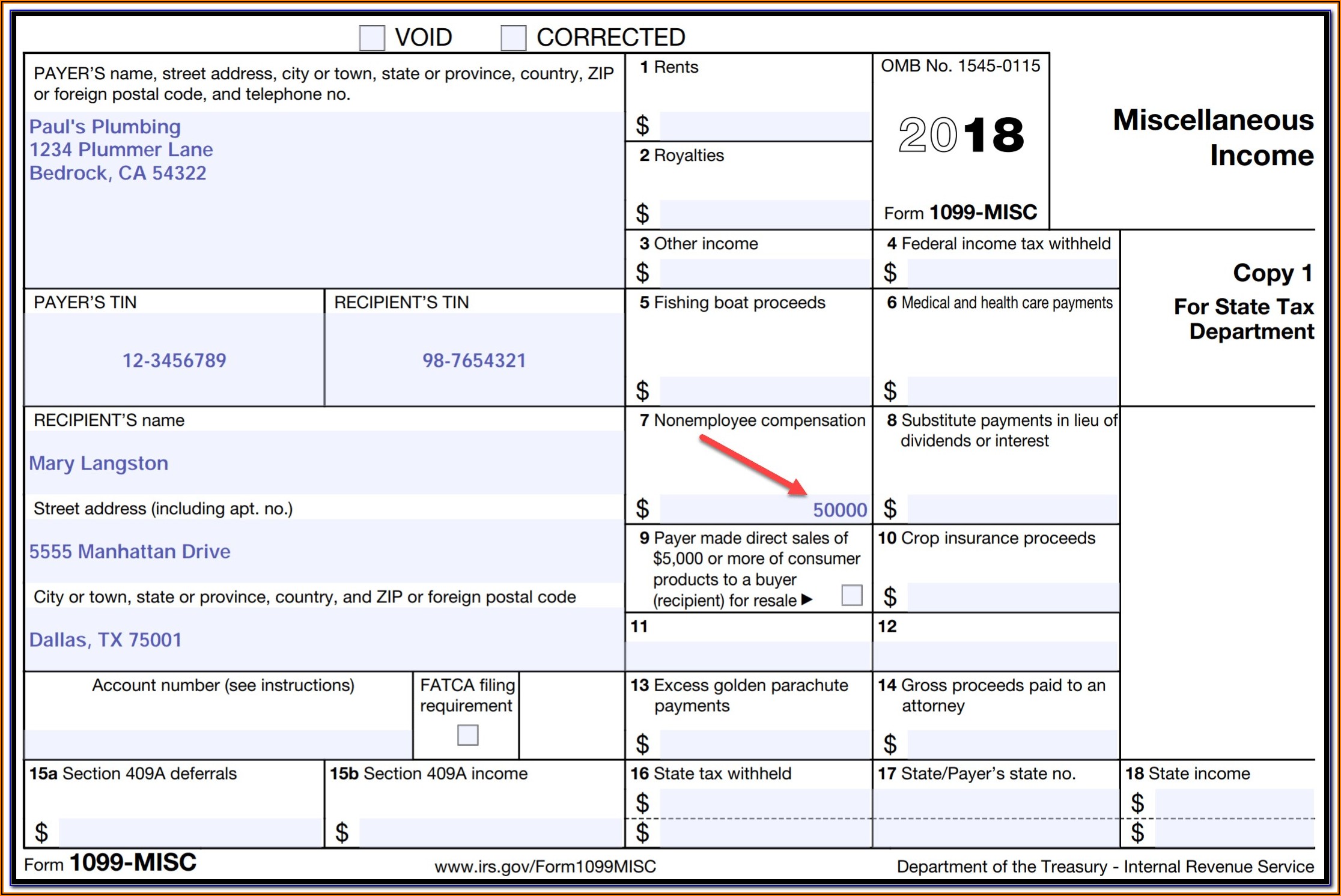

If you itemized deductions on your federal return in the same year that you received the state or local refund, the refund may be considered taxable income. Frequently clients don’t bring us the 1099gs for the state refunds and we are held up waiting to get the eins and addresses that would appear on the 1099gs. Here is the list of necessary information for all of the states’ 1099g. If you believe your tax identification number has been stolen and someone has filed a colorado tax return under your social security number (ssn), please fill out the report possible tax refund fraud form.