Chase Fha Loan Mortgage And Home Equity Review Top Ten Reviews

The main difference between a fha loan and a conventional home loan is that a fha loan requires a lower down payment, and the credit qualifying criteria for a borrower is not as strict. You may be eligible for either $2,500 or $5,000 in savings when applying for a dreamaker℠, standard agency, fha and va home purchase mortgage loan product and where applicable census tract requirements are met. This allows those without a credit history, or with minor credit problems to buy a home.

Apply for Chase Home Loan Online 2021 Chase Mortgage www.chase

The amount you save on a refinanced mortgage may vary by loan. The chase homebuyer grant is available on primary residence purchases only. If a refinanced mortgage has a longer term than remains on your current loan, you will incur additional interest charges for the extended term.

All home lending products except irrrl (interest rate reduction refinance loan) are subject to credit and property approval.

Federal housing administration (fha) loan. Speak with a chase home lending advisor for more specific information. Message and data rates may apply from your service provider. The chase homebuyer grant is available on primary residence purchases only.

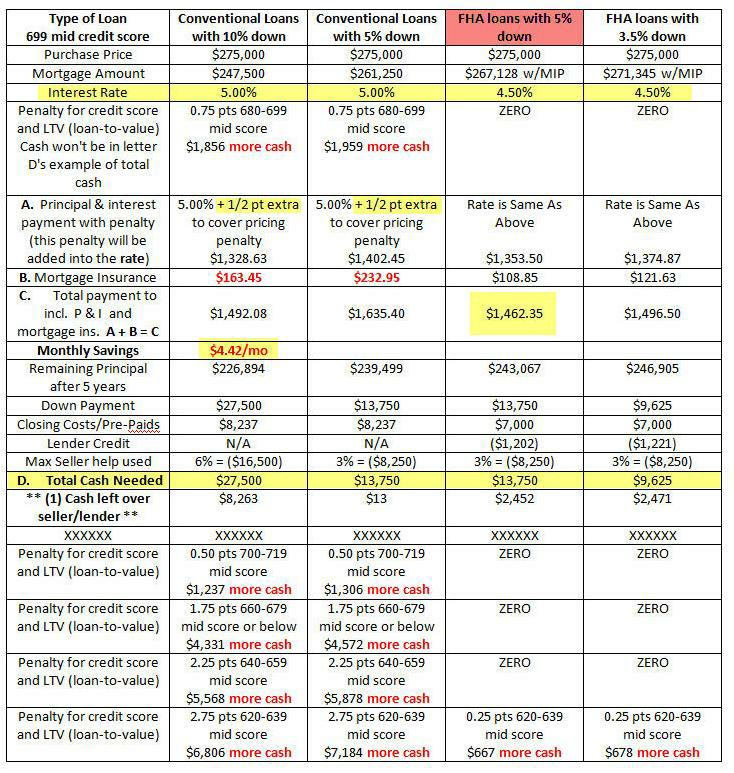

You may be eligible for either $2,500 or $5,000 in savings when applying for a dreamaker℠, standard agency, fha and va home purchase mortgage loan product and where applicable census tract requirements are met. Conventional loans aren't insured or guaranteed by government agencies. Differences between fha and conventional loans. There are several key differences between conventional and fha loans

Fha loans feature low down payment and more flexible guidelines.

See requirements & rates and find an fha mortgage that meets your needs at chase.com. An fha loan could make it easier to realize your dream of homeownership. Read our article to understand what fha loans are, how they work and how to get one. Our affordable lending options, including fha loans and va loans, help make homeownership possible.

Check out our affordability calculator , and look for homebuyer grants in your area. Visit our mortgage education center for helpful tips and information. Fha loans may offer homebuyers more flexible lending requirements and a lower down payment. Learn how to get an fha loan, the pros and cons and how to qualify.

Does chase have low down payment or low credit score mortgage options available?

Yes, we offer dreamaker, federal housing administration (fha) and veterans affairs (va) loans that offer low down payment options with flexible credit score requirements. Chase has increased its homebuyer grant from $5,000 to $7,500 in 15 markets across the u.s. Customers can use grant funds to lower their interest rate and/or reduce closing costs and down payment. Chase offers several appealing home buyer programs, including loans with 3% down payment requirements, homebuyer assistance grants and a payout for delayed closings.

To finance a new or used car with your dealer through jpmorgan chase bank, n.a. (chase), you must purchase your car from a dealer in the chase network. The dealer will be the original creditor and assign the financing to chase. All applications are subject to credit approval by chase.

Our affordable lending options, including fha loans and va loans, help make homeownership possible.

Check out our affordability calculator, and look for homebuyer grants in your area. Visit our mortgage education center for helpful tips and information. And from applying for a loan to managing your mortgage, chase myhome has you covered. Our affordable lending options, including fha loans and va loans, help make homeownership possible.

Check out our affordability calculator, and look for homebuyer grants in your area. Visit our mortgage education center for helpful tips and information. And from applying for a loan to managing your mortgage, chase myhome has you covered. Allow down payments of just 3.5% and have more flexible credit requirements.

We are in the process of buying a house and getting a mortgage from chase.

It’s been 3 weeks since the loan process started and we still don’t have the appraisal report in. Closing date is supposed to be on the 23rd of this month but our loan status is still under conditional approval. The amount is then divided by 12 and added to your monthly mortgage payment. Are fha loans eligible for down payment assistance?

If you apply for an fha loan, you can use down payment assistance and gifts. Our affordable lending options, including fha loans and va loans, help make homeownership possible. Check out our affordability calculator, and look for homebuyer grants in your area. Visit our mortgage education center for helpful tips and information.

And from applying for a loan to managing your mortgage, chase myhome has you covered.

Available on dreamaker, standard agency, fha and va mortgages; $5,000 can be used toward closing costs and down payment; The minimum fico credit score for an fha loan is only 580, however, while Our affordable lending options, including fha loans and va loans, help make homeownership possible.

Check out our affordability calculator, and look for homebuyer grants in your area. Visit our mortgage education center for helpful tips and information. And from applying for a loan to managing your mortgage, chase myhome has you covered. Our affordable lending options, including fha loans and va loans, help make homeownership possible.

Check out our affordability calculator, and look for homebuyer grants in your area.

Visit our mortgage education center for helpful tips and information. And from applying for a loan to managing your mortgage, chase myhome has you covered. Does not offer this type of loan. Any information described in this article may vary by lender.

When it comes to building a home from scratch or purchasing and renovating a new property, you typically won’t be looking at your traditional, permanent mortgage. That’s where a construction loan comes in.